23 Best Banks in CALIFORNIA (Most Trusted)

Financial institutions are one of the major pillars of society, without which many, if not all, other institutions will collapse or fail to function well.

At the heart of the financial institutions, and closest to the citizens, is the banking system, which and in its own right, assists industrious citizens with capital and loans.

Although banks come in different forms, commercial banks, microfinance banks, cooperative banks, or credit unions, at the core of their existence, they perform similar duties in society, maybe by different means.

Here are some top banks in cities and counties across the State of California.

And by the way, you may also want to check out the best Credit Unions in California.

Banks in Orange County, California

1. Credit Union of Southern California (Customer-Centric Approach)

Credit Union of Southern California is a bank in Orange County, California, that is friendly and ready to provide its services by being of assistance to people, ensuring that their customers achieve their financial goals and continue to thrive financially.

One of the bank’s common sayings is that the financial industry is filled with people who can count, but the goal at the Credit Union of Southern California is to be people you can count on.

The staff at Credit Union of Southern California are there to help their clients with products, services, and conveniences in a way that they spend smartly, save much more, and start planning and taking action rather than dreaming about it.

If you are in Orange County and want to get in business with any bank, the Credit Union of Southern California is a good one to start with.

Address: 655 S Main Street, Suite 240, Orange, CA 92868, US

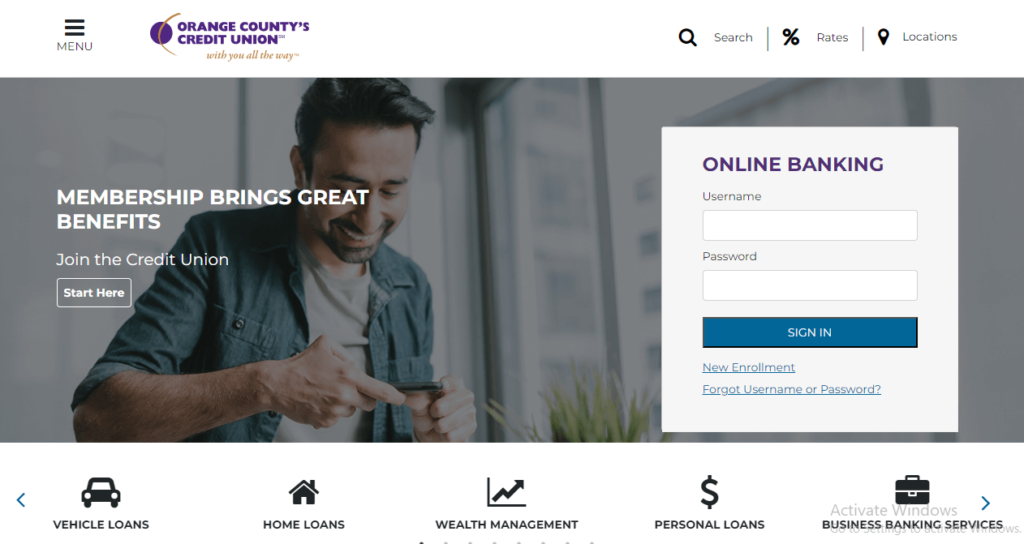

2. Orange County’s Credit Union (Diverse Services)

Orange County’s Credit Union was established in 1938 and used to be known as The Orange County Employees Credit Union, which meant that it only serviced people who worked in Orange County, but today, membership of the bank has expanded to include anyone that lives or works in Orange, Riverside, San Bernardino, and Los Angeles Counties.

In addition to major banking services, like checking, savings, and Mobile Banking, Orange County’s Credit Union also offers Mastercard Credit Cards, Accounts for Students & Children, Personal Loans & Lines of Credit, Auto Loans, and Investment Advice & Products.

Other services and products include Business & Commercial Services, Home Loans, Fiduciary & Trust Accounts, and other Online Services like iPhone & Android Apps, Mobile Check Deposit, Online Transfers, Bill Pay, Alerts/Notifications, Debit Card Controls, and so on.

All of these are so it provides their customers with as good a service as they can find elsewhere, if not better.

Address: 2390 E Orangewood Avenue, Ste 106, Anaheim, CA 92806, US

3. Pacific Premier Bank (Strategic Growth)

Pacific Premier Bancorp, Inc. is the parent/holding company of Pacific Premier Bank, and this means that the latter, which was established in 1983, is a fully-owned subsidiary of Pacific Premier Bancorp with its headquarters in Irvine, California, and branches all across the nation, to serve individuals and businesses throughout the United States.

The bank is worth well over $21 billion in total assets, making them one of the fastest-growing and strongest-performing banks, as well as a leader in the nation’s banking and finance industry.

Pacific Premier Bank remains dedicated to providing its clients with unrivaled services and making sure that their shareholder values continue to rise, even in the face of tricky economic and financial conditions.

This award-winning bank is one of your best bets in banking, and with branches everywhere, your banking experience gets easier.

Address: 1045 W Katella Avenue, Orange, CA 92867, US

4. Farmers & Merchants Bank (Century-Old Integrity)

Farmers & Merchants Bank was established in 1907, which means that they have been around for over a century; so, harmed with such an immense wealth of banking experience, the bank continues to operate on its essential principles of integrity, compassion, faith, honesty, and service as put in place by the founder, C.J. Walker.

At Farmers & Merchants Bank, they continue striving to build long-lasting relationships with their clients, who benefit from decisions reached by the bank in helping them attain their financial goals, all the while giving back to the community.

F&M, otherwise called, offer the following services to their clients, and they include Individual Banking Services – Savings, Checking, Online Banking – Health Savings, Money Markets, Personal Visa Cards, Retirement Plans, Home Loans, Escrow Services, and so on.

Address: 1220 E Katella Avenue, Orange, CA 92867, US

Also see our article on Internet Providers in California.

Banks in Davis, California

1. First Northern Bank (Century-Long Commitment)

First Northern Bank was founded in 1910 and opened its doors for operation precisely on February 1, 1910; with over a century of experience, First Northern Bank has remained faithful to its foundations and core beliefs as a financial institution formed to cater to well-tailored personalized needs.

The bank has continued to serve such needs with an unwavering dedication to high-end personal service and devotion to assist and reinvest in each of the communities where the bank serves.

They seek to build long-lasting relationships to continue to address specific financial needs on an individual basis, provide opportunities for our employees, and be passionate and loyal to making a difference in the community.

First Northern Bank, as earlier mentioned, continues to serve the business, professional, and personal requirements of the people in multiple counties, including Solano, Yolo, Sacramento, and so on.

Address: 434 Second Street, Davis, CA 95616, US

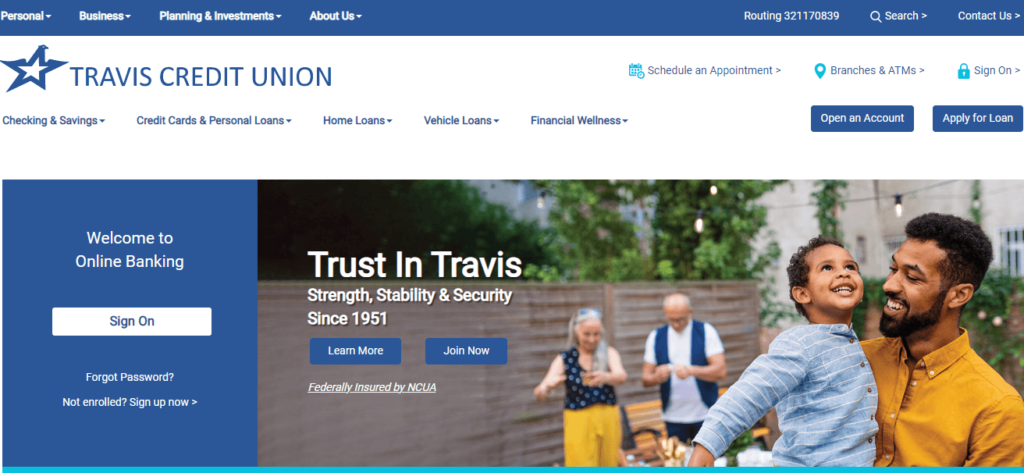

2. Travis Credit Union (Military Origin)

Travis Credit Union was founded in 1951 by some civilian and military workers at Travis Air Force Base in Fairfield, California, and as part of the movement that began years before, in the 1930s, the bank still takes pride in helping to make a financial difference in the lives of their members.

It is a non-profit financial cooperative committed to building long-lasting relationships with its members to help them achieve their financial goals.

With over 225,000 member-owners and their well-placed trust in Travis Credit Union, the credit union has now grown to 24 branches and $4.7 billion in assets today.

The members and potential members should know that in a bid to ensure your peace of mind that your money is secure, all TCU deposit accounts are federally insured by the National Credit Union Administration (NCUA).

Address: 1380 E Covell Boulevard, Davis, CA 95616, US

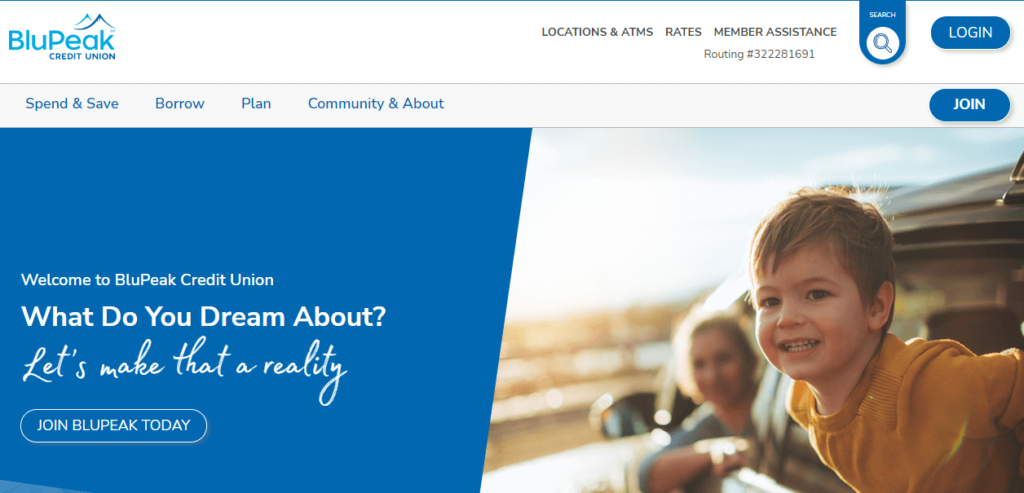

3. Blupeak (Eight-Decade Evolution)

Blupeak story began over eighty (80) years ago when credit unions were just cropping up in the United States.

On April 20, 1936, Blupeak was formed by a group of dedicated and passionate people to serve the financial needs of San Diego’s Division of Highway employees.

Although it was known as California State Employees Credit Union #17 at the time, it quickly grew and extended membership to other state employees, which includes faculty and staff of many of California’s colleges and universities.

As a result of this, later in 1971, the name was changed to University and State Employees Credit Union to reflect the largely expanded membership base.

Currently, BluPeak has over $1 billion in assets and offers a wide range of financial products and services to about 60,000 members across the state of California.

Address: 200 B Street, Davis, CA 95616, US

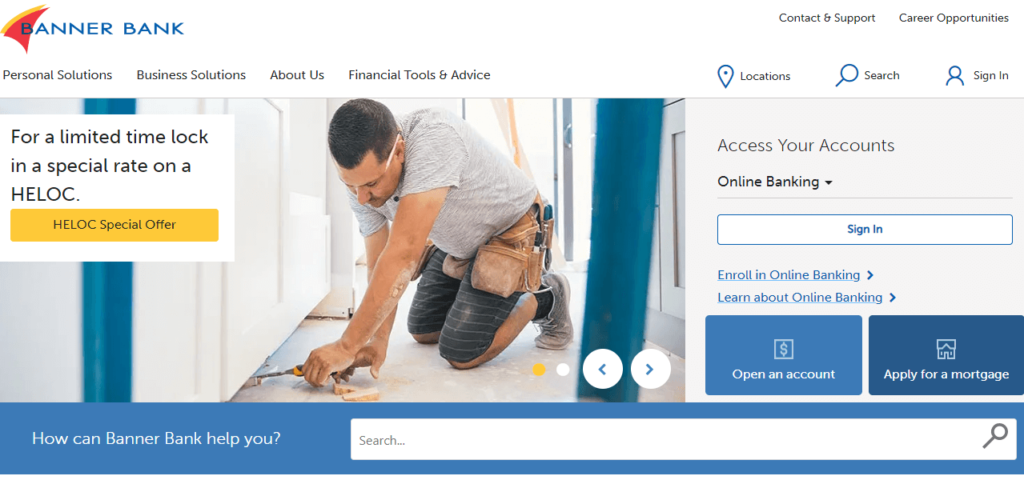

4. Banner Bank (Community Connection)

When you walk into any Banner Bank branch close to you and speak with the staff, something will most likely strike you about the conversation and stand out, and that is unlike many other banks; this is your community bank.

Here, the staff actually care about you, knowing your name, your interests, and your goals, and helping you achieve them, not just another number in the annual reports.

Since its establishment in 1890, Banner Bank has remained dedicated to providing the best financial services in the country, and throughout more than 130 years of history, the bank has focused on delivering competitive, efficient, and effective financial services to the clients they serve.

Banner Bank is a spirited full-service financial institution that operates profitably, yet safely, within the confines of its core values, honesty, and shared integrity.

Address: 333 F Street, Suite A, Davis, CA 95616, US

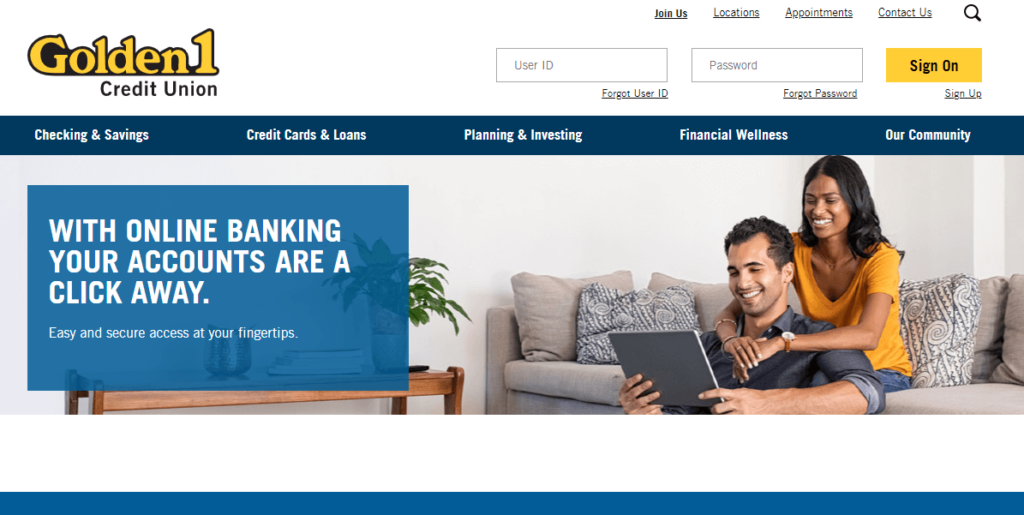

5. Golden 1 Credit Union (Decades of Cooperatives)

Ninety years ago, in 1933, a group of people came together in Sacramento and created a financial cooperative with the aim that hard-working residents of California would pool their financial resources together to help one another achieve financial freedom.

Currently, that credit union, Golden 1 Credit Union, is one of the nation’s leading credit unions, with approximately $19 billion in assets.

In spite of the immense growth, Golden 1 Credit Union still remains dedicated to continuing to affirm the aim of delivering financial solutions with value, convenience, and impeccable service to its members.

As a non-profit cooperative, Golden 1 Credit Union return the earnings to its members by offering higher returns on their savings, reducing the interest rates on the loans they take out, and a broad array of free services, including charge-free ATMs nationwide.

Address: 508 2nd Street, Suite 101, Davis, CA 95616, US

Also see our article on Security Companies in California.

Banks in Beverly Hills, California

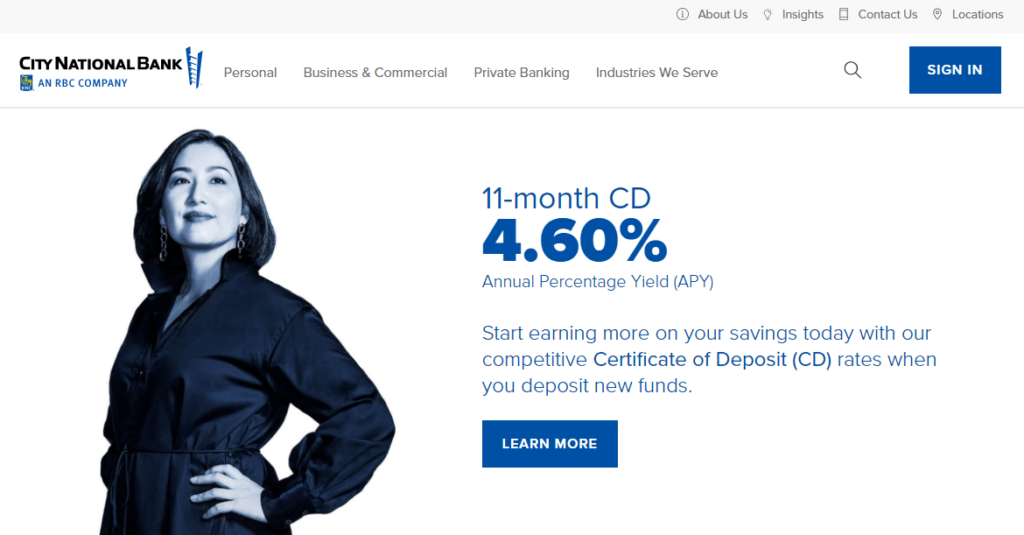

1. City National Bank (Holistic Financial Services)

City National Bank in Beverly Hills, California, provides unrivaled financial services, which include private banking, business banking, retirement planning, estate planning, wealth management, investment management, loans, and so much more.

Established in 1954, City Nationa has continued to strive to achieve its mission, which is to deliver a great banking experience for entrepreneurs and professionals and ensure their growth through an utmost commitment to top-notch service, financial advice, and comprehensive solutions.

At City National Bank, customers are not dealt with only on the business level but also on a personal front, as they have always prioritized assisting not only the clients but colleagues and the communities they serve as well.

As an FDIC member bank with over more than $95 billion in assets, City National Bank is one of the giants in the banking and finance industry, and you will not regret banking with them.

Address: 8641 Wilshire Boulevard, Suite 101, Beverly Hills, CA 90211, US

2. First Republic Bank (Three-Decade Expertise)

Established in 1985, thus with over 35 years of experience in the banking world, First Republic Bank prides itself in providing banking, wealth management, and so on to its customers.

First Republic Bank specializes in providing extraordinary, relationship-based service and offers a complete line of products, which include loans (residential, commercial, and personal), deposit services, and as earlier stated, private wealth management, life insurance, trust, investment, brokerage, and foreign exchange services.

These services are on offer through their banking or wealth management offices primarily in some cities in California like Palo Alto, Santa Barbara, Los Angeles, San Francisco, Newport Beach, and San Diego.

The bank does not care much about its own growth, but it is inevitable, especially when you consider the exceptional services available to the clients and communities.

Address: 9593 Wilshire Blvd, Beverly Hills, CA 90212, US

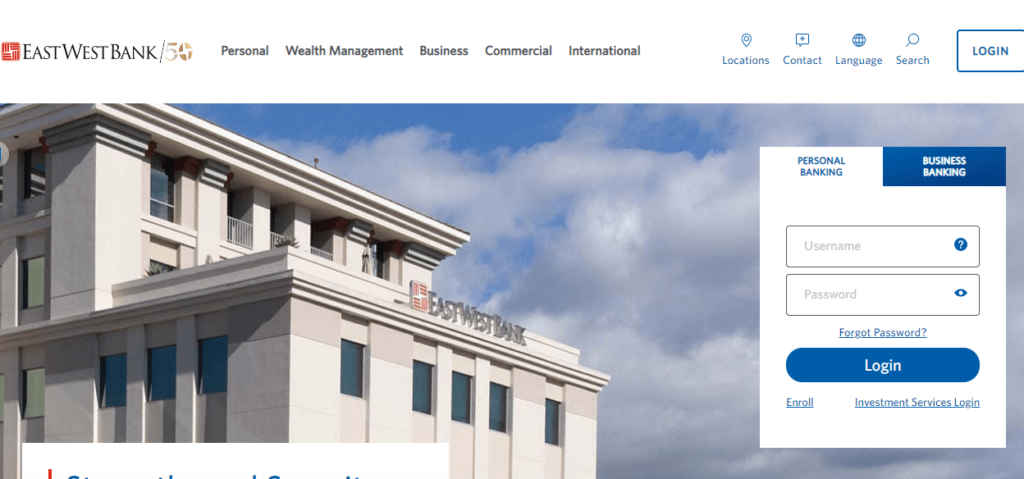

3. East West Bank (Community-Centric Roots)

1973 was the year East West Bank first opened its doors to the public, with a laser-focused ambition of serving the financial needs of Chinese Americans in Los Angeles that were always sidelined by mainstream banks.

East West Bank was the first federally-chartered savings institution to focus on their community and did its best to be a financial refuge for the people undermined by racial discrimination and bias, and since then, for 50 years and counting, it continues to take a leading role in elevating the said communities and grow along with them.

With over 120 branches throughout the US and Asia, East West Bank is currently the largest independent bank with its headquarters in Southern California and has still not altered its course on building financial and cultural bridges, helping bigshot commercial clients connect to emerging opportunities while expanding its international network.

Address: 9378 Wilshire Blvd, Suite 100, Beverly Hills, CA 90212

4. Pacific Western Bank (Relationship Foundations)

At Pacific Western Bank, one of the core beliefs is that a good relationship is the best foundation on which to build a business, and this has been the bank’s mantra for as long as it has existed; that is why the staff and clients all work together as a team to achieve the customer’s financial goals.

The bank was founded more than two decades ago and has since continued to show the world that when qualified and dedicated people come together for the sake of clients, lines fall in place, and terrific things happen.

In the course of its existence, Pacific Western Bank has grown to become a diverse bank with an ever-growing number of excellent employees, diversified clientele, and ongoing acquisitions.

Employees, clients, and these multiple acquisitions have all made impactful and positive contributions to the image of the bank to the public.

Address: 9320 Wilshire Blvd, Suite 105, Beverly Hills, CA 90212, US

Also see our article on Chemical Companies in California.

Banks in Glendale, California

1. Glendale Federal Credit Union (Member-Centric Approach)

The Glendale Federal Credit Union is a full-service, non-profit, member-owned financial institution committed to giving its members immense value and exceptional service and aim to achieve your financial needs.

Since its establishment in 1951, Glendale Federal Credit Union has been assisting its members in attaining their goals by delivering quality financial products and convenient services that prioritize the members’ needs.

Founded on the general credit union philosophy of people pulling their resources together to assist one another, the members enjoy a credit union that has taken this a step further with unwavering devotion to their best interests.

As a non-profit financial cooperative, the credit union returns earnings to members by increasing their dividends, reducing the interest rates on loans, and providing other services tailored to cater to the members’ needs.

Address: 500 E Wilson Avenue, Glendale, CA 91206, US

2. Glendale Area Schools Credit Union (School-Centric)

In 1937, a couple of teachers in the Glendale Unified Schools District came together to form the Glendale Area Schools Credit Union to assist with the needs of the local schools and local community, and it has since then continued to do so.

The credit union supports the school relationships in numerous ways to ensure the financial needs of school staff, PTA, students, and every other stakeholder are met.

Much like heart desires, financial needs vary, but all these needs have been tailored under a single mantra at Glendale Area Schools Credit Union – services are provided to benefit the members, not to generate profit for the Credit Union.

This monopolistic commitment, coupled with the credit union’s financial reliability for its members, are the major reasons behind the Credit Union’s success.

Just like banks, Glendale Area Schools Credit Union offers a full range of suitable financial services, but that is about the extent of the similarity, as they differ in ownership, control, and objective.

Address: 1800 Broadview Drive, Glendale, CA 91208, US

3. SchoolsFirst Federal Credit Union (Educational Community Focus)

Much like Glendale Area Schools Credit Union, SchoolsFirst Federal Credit Union is also a credit union only for school staff and their family members in California.

Although the Glendale Service Center is a cashless location that provides limited services, cash is readily available at the onsite ATM for deposits as well as withdrawals.

Federally insured by NCUA, SchoolsFirst FCU’s membership is open to employees and retirees of eligible private and public schools, school districts, community colleges, universities, and education foundations across the state of California.

Immediate family members, including spouses, partners, parents, siblings, offspring, grandparents, and grandchildren of existing members, can also become members of the SchoolsFirst Federal Credit Union.

Some of the perks of being a member include low-interest home and personal loans, insurance, retirement planning, credit cards, investments, savings and share certificates, free checking, and so much more.

Address: 223 N Jackson Street, Suite 113, Glendale, CA 91206, US

4. Los Angeles Federal Credit Union (Depression-Era Foundation)

In 1936, right around the time the Great Depression was at its peak in the nation, some Los Angeles City employees came together, pooled their resources of $60, and founded the ‘Los Angeles City Employees Federal Credit Union’.

It was a local credit union to offer the scarce opportunity to fellow City employees to get access to a safe, low-cost source to borrow and save money amidst the challenging economic conditions.

Today, the name has changed to Los Angeles Federal Credit Union (LAFCU), but the intent behind its creation is still very much unchanged as it provides a source for affordable financial services to their fellow workers and offers free Checking and Savings accounts as well as low-rate vehicle and real estate loans.

With about 73,000 members, including Los Angeles City employees, retirees and volunteers, their families, and so on, membership is always open to residents of the Greater Los Angeles Metropolitan area.

Address: 300 S Glendale Avenue, Glendale, CA 91205, US

Also see our article on Real Estate Companies in California.

Banks in Inglewood, California

1. California Credit Union (Educational Community Service)

California Credit Union is a federally-insured, state-chartered credit union established in 1933 to serve public and private school employees, community members, and businesses across the state of California.

Since its creation, the Credit Union has evolved to become one of the biggest insured state-chartered credit unions in California and is unwavering in its devotion to aiding the financial goals of its members all around.

With over 170,000 members and more than $4.5 billion in assets, California Credit Union has 24 branches across Los Angeles, Orange, and San Diego counties.

California Credit Union prioritizes its members, and with ease in accessibility, it offers the community, entrepreneurs, educators, and everyone that has been of service to the nation secure and stable financial services they can rely on and assistance that will help secure a better financial future.

Address: 3550 W Century Blvd, Inglewood, CA 90303, US

2. U.S. Bank Branch (Customer-Centric Approach)

In 1863, the Lincoln administration signed national bank charter No. 24, and since then, the U.S. has drawn on financial strength to serve its customers by providing loans, credit cards, and so on,

The U.S. Bank has proven, times without number, that they care much more about their customers rather than the business and figure side of things, and this was especially reflected in 2020, during the COVID-19 pandemic.

By the end of that year, the bank’s program included a $20 million premium pay program for its employees, loans for its customers, relief assistance, about 108,000 Small Business Administration Paycheck Protection Program (PPP), and millions of dollars in contributions for the community.

Also, the bank recognizes the major shift of the banking system to digital products and services like online banking, mobile applications, and the like and has put itself in a good position for this new future.

Address: 3366 W Century Boulevard, Inglewood, CA 90303, US

3. City First Bank (Community Impact)

City First Bank and Broadway Federal Bank entered into a merger recently, and this has made City First Bank the biggest Black-led Minority Depository Institution in the United States, with billions of dollars in assets and over $700M in deposits.

This has helped in expanding its reach, deepened its lending capabilities, and refocused its mission of channeling money and finance as a force for good.

The bank works with several non-profits, that have mutual board members as well as management, as a single corporation with a mission and strategy to support economic justice.

City First Bank offers a strong and impactful lending program, as well as a deposit platform, with its large electronic presence of global ATMs, applications, and 24/7 customer care center, which all enable its customers to bank easily from anywhere in the world and at any time.

Address: 170 N Market Street, Inglewood, CA 90301, US

Also see our article on Window Companies in California.

Banks in San Jose, California

1. PremierOne Credit Union (Merged Expertise)

One of the main beliefs at PremierOne Credit Union is that their members must have peace of mind regarding their finances, and it is because of this that the credit union provides numerous top-notch services to actualize your financial freedom, and they include financial advising, discount tickets, low-rate loans, student accounts, financial education and so on.

Established in 2013, PremierOne Credit Union is the merger of two credit unions rich in history and have immense experience; National 1st Credit Union, which was originally formed in 1968 for National Semiconductor employees, and San Jose Credit Union, founded in 1932 to serve employees of the City of San Jose.

The resulting PremierOne Credit Union focuses on building a lasting relationship with its members while providing more access and convenience in delivering a better financial life.

Address: 6640 Via Del Oro, San Jose, CA 95119, US

2. Metropolitan Bank (Community Empowerment)

Metropolitan Bank specializes in being a community bank, offering its services to San Jose’s small businesses and people that do not have access to financial services from bigshot financial institutions because of language barriers, lending formulas, and any other obstacle you can think of.

Perhaps, being established in 1984 in the heart of Oakland’s Chinatown decades years ago had a lot to do with the bank’s modus operandi, and having started out as a bank to serve and give back to the community, the bank, even after all these years have not deviated from the path.

While other banks come up with new ways to deal with their clients at an arm’s length, Metropolitan Bank remains devoted to the idea of bank-customer relationships being up-close and personal.

Address: 1816 Tully Rd, Suite 192, San Jose, CA 95122, US

3. First Tech Federal Credit Union (Member-Centered Services)

Unlike most banks, First Tech Federal Credit Union was created and existed to serve its members, so rather than chase after profit, they put in their time, passion, and experience to work for you, its members.

First Tech Federal Credit Union offers services that prioritize your future and also tailor these service to fit each member and help jumpstart your financial goals; some of these services is their competitive loan rates.

The credit union is devoted to helping you go further with your finances with every step you take in life, and with more than 550,000 members, including the world’s most forward-thinking companies like HP, Microsoft, Amazon, Nike, and so on, you are in good company.

So, join First Tech Federal Credit Union today, become a member, and start investing in your future.

Address: 181 E Tasman Drive #10, San Jose, CA 95134, US

If you liked this article, you may also like to read about the best Construction Companies, Manufacturing Companies, and Companies to work for in California.

Looking beyond California? Check out our article on the best banks in Texas and Florida’s most reliable banks.