23 Credit Union in CALIFORNIA (Trusted, Stable, & Reliable)

Credit unions’ personalized approach and uniqueness have made people’s lives easier and well-structured.

These unions are widely dispersed in California, making it the hub of associations and offering a distinctive approach to banks.

And enable the individuals to take control of finances and even build resources from it.

It is specifically community-based to fulfill the requirements of the people.

California credit unions are trustworthy, with lower fees, community-focused service, and broader benefits.

As with vast community-driven credit unions, silicon valley has become the financial hub to help the business grow.

So, the top-rated credit unions with the best services are hereunder.

And by the way, you may also want to check out the best Banks in California.

Credit Union in Sacramento, California

1. Patelco Credit Union (Financial Freedom)

Patelco is one of the largest credit unions in the United States that gives people hope and financial freedom.

The low loan fee has made buying your dream house or car possible, giving you the happiness you deserve.

Professional financial advisers will help you with investments, and you can also take command of your business by trading anytime.

And the digital banking system is well-expanded and helps community members with their financial life.

Along with life insurance, home, and payment protection insurance with minimal fees make it distinct from others and make your life carefree.

There is no fee to become a Patelco member, but there are a lot of benefits ranging from better-saving rates to discounts on your daily expenses.

Address: 2425 Fair Oaks Blvd Suite 6, Sacramento, CA 95825

2. California Community Credit Union (Residency Requirement)

A community grows if like-minded people start building bonds, and with California, Community bond grows because members get treated like family.

With the wide variety of loan options, the members can ask for personal, home, or mortgage loans covering every aspect with the lowest rates.

There is only one requirement to become a community member: the individual should be a resident of Sacramento, and there’s no fee.

And after partnering with the Sallie Mae community is focused on providing higher education to students by providing them with student loans.

It has made banking easy with online banking and bill payment systems.

The community will help you grow your business and track your business online.

Address: 8815 Folsom Boulevard, Sacramento, CA 95826

3. Sacramento Credit Union (Business Expansion Support)

The main objective of Sacramento credit union is to provide competitive and robust financial services to its members and build a friendly environment.

From checking accounts to money market accounts, you can benefit by opening the budget of your choice.

Youth account, for those under 18 years old, is specifically made to teach your kids financial management and give them real-world experience.

SCU helps in the expansion of businesses and also refinances them with interest rates to deliver value to your business.

You can borrow up to $5 million with minimum interest rates of 1% and a minimum down payment of 25%.

Furthermore, with the core value of community building, SCU provides personal and house loans.

And insurance protects the Sacramento community from financial losses and advises them on their finances.

Address: 800 H Street, Sacramento, CA 95814

4. Safe Credit Union (Wealth Management Strategies)

Forbes has ranked Safe as one of the best credit unions in the state because of its professional customer service and support.

Professional financial advisors and wealth management strategies will help you pursue your well-being and financial goals.

Sometimes borrowing money is essential to fulfilling your needs, and with Safe, you will feel safe from the harsh conditions.

If you invest money with Safe, you can open checking or saving accounts to keep track of money.

And with an online banking system, you can deposit checks from home and pay your bills.

Maximizing the savings and saving the money for your family with up to 5% of APY, you will see your money growing.

Address: 6341 Folsom Blvd, Sacramento, CA 95819

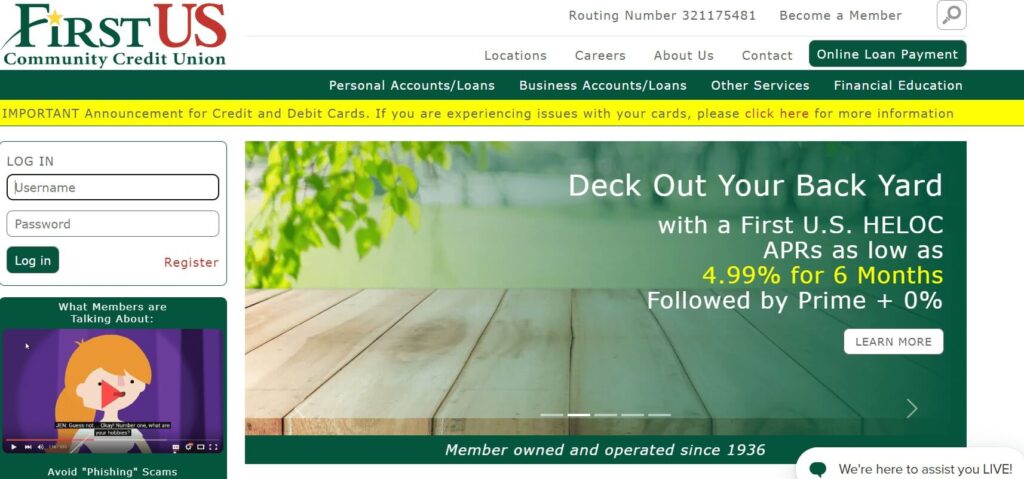

5. First US Community Credit Union (Specialized Financial Services)

First US Community is the leading credit union scattered throughout the nation with the motive of providing special financial services to enhance the members’ lives.

With the community in focus, it thrives on providing personal and real state loans and energy efficiency loans to restructure your homes.

Also, with different checking accounts, you can freely perform all the essentials and keep track of your funds.

Here the community will provide small business financing and 100% business equipment loans with 3-5 years of easy terms to help you grow.

And help your business to grow with eStatements that are safe, smart and convenient to use, and easy to track the industry.

To pursue higher education, it provides educational loans and teaches students financial management.

Address: 580 University Avenue, Sacramento, CA 95825

Also see our article on Life Insurance Companies in California.

Credit Union in Downey, California

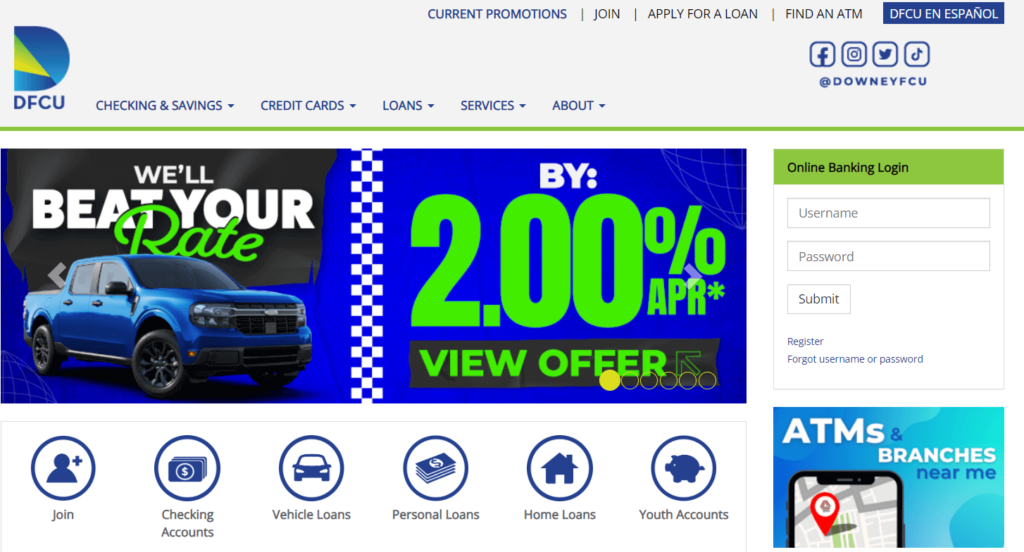

1. Downey Federal Credit Union (Checking & Savings Accounts)

With professional and community-focused customer support, DFCU has helped local businesses to grow and become stable.

To help and teach the students, the Youth Literacy Program and Account allows those under 18 to open an account and manage money.

Now, checking and saving accounts will help you to save money to meet your financial goals.

And minimum balance requirement for the money market is $2500, which you can access whenever needed.

DFCU credit cards provide 0% APR for the first six months and no annual fee.

The Payday alternative loan program will free you from higher interest rates and provides you financial stability where you can get a loan up to $2000.

It provides assistance from professional financial advisors to help you with your finances and give you a hand on business settlement.

Address: 8237 3rd St, Downey, CA 90241

2. Financial Partners Credit Union (Wealth Management Assistance)

By giving lower fees than banks and with the main focus on customer support, it is building financial customers by valuing their time and money.

After learning about your savings and future goals, FPCU will navigate and assist you in wealth management to meet your financial goals.

To turn your after-retirement life into a quality life, professional financial advisors will help you invest the money.

Here, FPCU focuses on the Rule of 72, giving the estimated time after the asset value doubles.

You can open saving accounts for all purposes, and the Christmas club helps you to keep your all year from your money for merrier celebrations.

With mobile banking, you can track your business, and the Digital wallet has made transactions faster and better.

Address: 7800 E Imperial Highway, Downey, CA 90242

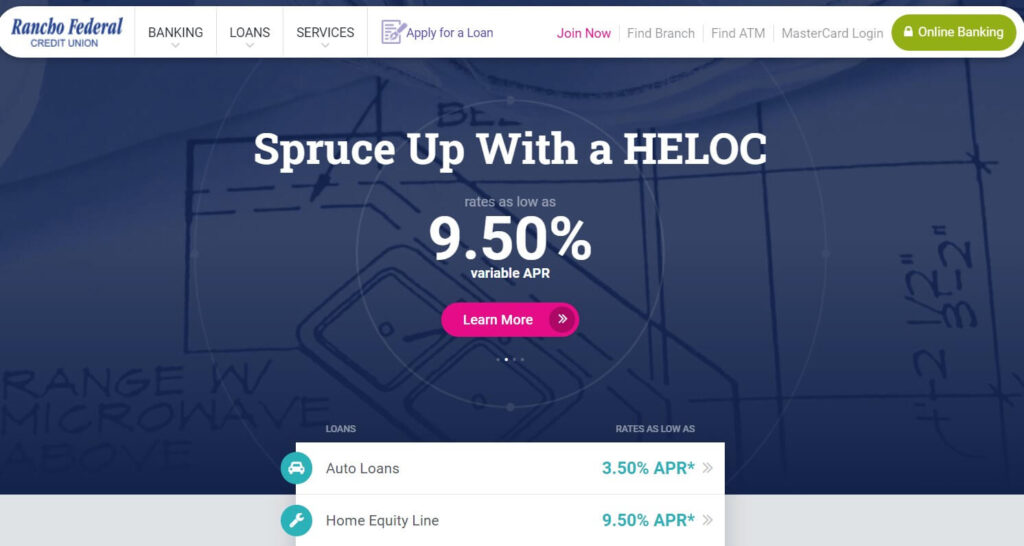

3. Rancho Federal Credit Union (Professional Financial Services)

Rancho Federal Credit Union offers professional financial services and the best customer care support to its members only.

The Rancho Federal Mastercard is convenient and can be used to purchase items and deducted from checking accounts.

To be a member of the Rancho Federal saving account is necessary, and the money market helps you earn more a minimum balance of $2500 is required.

Life will be easier with a Bill Consolidation loan, where all bills roll into one with an affordable monthly payment, which will be much lower.

Payday assistance loans will get you out of debt, and secured loans offer access to funds with lower interest rates.

A professional financial planner will give you financial freedom and help you obtain TruStage Insurance according to your budget and needs.

Address: 12620 Erickson Ave H, Downey, CA 90242

Also see our article on Security Companies in California.

Credit Union in Fresno, California

1. Educational Employees Credit Union (Cash Crew & Kids Club)

The friendly environment and community-driven approach have made it the more intelligent banking system operating to provide financial relief.

Saving accounts of up to $250,000 are backed by NCUA to give you easy access and flexibility in managing and utilizing your savings at the right time.

And checking accounts let you manage your spending and save money.

To facilitate those under 17 years, the cash crew and kids club help them open an account for $5 and get a free ATM card.

With minimal fees on education and technology loans, you can apply online or in-person application and online payments are transferred.

Insurance will cover you during any accidents and protect your finances.

Address: 1177 Van Ness, Fresno, CA 93721

2. Noble Credit Union (Health Savings Benefits)

The noble credit union has always cared for its assets, employees, and members, giving them opportunities for a more fantastic financial future.

With CUSO Financial services, your investments are safe, and you will work hard to meet your financial goals.

And professional financial advisors will guide you step by step and help you create financial plans.

Health savings accounts cover all your medical expenses and can provide tax-free benefits.

To keep track of your growing money Share Certificate provides you best competitive rates and gives you peace of mind.

You can send loan payments, check the history of transactions with online banking, and store money in your mobile wallet.

Address: 4979 E University Ave, Fresno, CA 93727

3. Greater Valley Credit Union (Central Valley Membership)

The most stable financial institution is owned and governed by members and devises the credit union’s policies.

Any person living in or near the central valley can become a member by depositing a minimum of $5 in Regular shares saving account.

Money Market Accounts allow you to earn higher dividends with a minimum deposit of $1000.

With the Coverdell education savings account, you can contribute annually $2000, and withdrawals are tax-free for educational expenses.

Energy Efficient loans with different terms and conditions help you to acquire energy-efficient products to curb your energy expenses.

Real estate loans with HELOC enable you to use them according to your needs, and a rate of 5% makes it distinct from others.

Address: 1185 W Hedges Ave, Fresno, CA 93728

Also see our article on Real Estate Companies in California.

Credit Union in Glendale, California

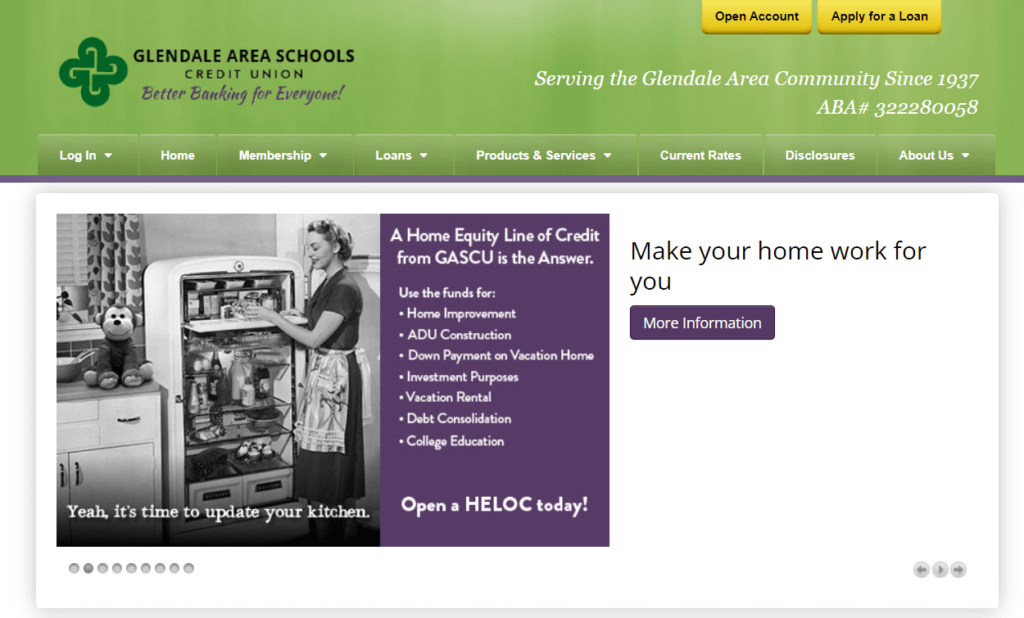

1. Glendale Area Schools Credit Union (Great Wealth Management Affiliation)

This credit union provides financial services in the best interest of its members and professional staff will take care of your needs.

And it reinforces and provides financial services to support the local community of schools, students, and parochial schools.

Its affiliation with Great Wealth Management helps to build a strong solid foundation and provides long-term financial planning.

Now you can open a savings account to save for your holidays with a minimum deposit of $5 with no fee and penalty-free withdrawal.

Guaranteed Auto Protection will cover the difference between loans and primary insurance in case of an accident.

With a primary focus on students, Sallie Mae provides student loans with fixed and variable rates and without prepayment penalties.

Address: 1800 Broadview Dr, Glendale, CA 91208

2. Glendale Federal Credit Union (Quality Services for Well-Being)

The financial well-being of people lies in the quality of services helping them to reach their goals of financial stability.

Kasasa is an automatic saving account with high dividends and provides up to 1.50% APY on funds of $20,000.

Furthermore, Kasasa is free with no maintenance fee and automatically qualifies you for rewards and a higher saver rate.

Trust accounts make a difficult time easier and avoid the expenses and difficulties related to probate taxes.

During personal needs, only a simple signature provides you with a simple solution with competitive rates and easy repayment terms.

And enjoy auto and home mortgage loans with simple and variable or fixed competitive rates.

You can notarize your documents free of charge and also have access to friendly legal assistance.

Address: 500 E Wilson Ave, Glendale, CA 91206, United States

Also see our article on Companies to work for in California.

Credit Union in San Diego, California

1. Navy Federal Credit Union (Military-Focused Stability)

It is the country’s leading and most trusted credit union, serving military personnel and their families at best.

When deployed, you will get the funds without any cuts, and the Ultimate certificate strategy helps you earn more.

And with retirement savings and the money market, your savings will boost automatically, giving you the perfect retirement gift.

Now military officials will get loans to make mortgage preapproval an added advantage and enjoy personal and auto loans with lower fees.

Helping the students by giving loans or refinancing the existing loans with lower rates, you should focus on education.

Professional financial advisors will help you prepare your finances, giving you financial tips and strengthening your financial fitness.

Address: 762 Dennery Rd, San Diego, CA 92154

2. California Coast Credit Union (Equity & Diversity Commitment)

Cal Coast embarks on providing the San Diego and Riverside communities equity, diversity, and the highest level of service.

You can open up free checking accounts and different checking accounts you will be charged with no extra fee and secure a free debit card.

The various savings accounts and financial advisors will track down and choose the best version according to your unique needs and with better rates.

With experts, local financial advisors, and wealth management, the Cal Coast has all the resources to expand your retirement savings.

And if you are looking to refinance or buy a home, it covers you with different loan rates according to your ease.

Platinum student MasterCard with no annual fee and train the students to maintain their finance.

Address: 440 Beech St, San Diego, CA 92101

3. San Diego County Credit Union (Financial Planning Support)

SDCCU competes with big banks and offers community members everything they want and better advantages.

Banking with saving accounts offers higher returns and long-term and short-term planning.

And money markets accounts provide you with higher rates with maximum returns.

Individual retirement accounts will help you to invest and enhance your savings, and this IRA also offers tax-free savings.

Personal loans give financial relief in difficult times and can be applied online at low rates.

San Diego county credit union will provide loans to turn your homes into a home equity line of credit (HELOC) or fixed-rate home equity loans.

Financial advisors will help you build intelligent money management decisions and enable you to buy a house in San Diego.

Address: 13179 Black Mountain Rd #3, San Diego, CA 92129

4. Mission Federal Credit Union (Community-Driven Objectives)

Community members govern Mission Federal with an objective of people over profits because everything is for the people.

For investment planning, the financial advisors will collaborate with you and devise a financial plan according to your investment plan.

The retirement account with different IRA savings accounts helps you to save your money tax-free with other saving accounts.

And you can transfer money from the retirement plan to Mission Fed IRA without tax consequences.

It provides better and more competitive rates on home loans and enables you to buy or refinance a home with perfect loan plans.

You can get home, life, and debt insurance to keep you safe from accidents and financially independent.

Address: 2020 Camino Del Rio N #100, San Diego, CA 92108

5. Cabrillo Credit Union (Personal Finance Management)

Primarily established to give financial institutions to border patrol agents with honesty, empowerment, and community-focused as its core values.

Cabrillo Advanced Relief Effort is a premium program to deal the financial crisis during natural disasters or governmental shutdowns.

And, auto loans to help you get your first car and personal loans for special occasions and to keep you away from debt.

With a $5 savings account, you’ll become a member, and opening a Holiday Club account will automatically cut a specific amount for your savings.

The liquidity of Market IRA makes your withdrawals and deposits at your easy.

Personal financial management will help you to keep track of your money and set the budget for your savings.

Address: 880 Front St, Ste 2295, San Diego, CA 92101

Also see our article on Gas Companies in California.

Credit Union in Palmdale, California

1. First City Credit Union (Five-Star Quality Services)

First City is the leading credit union with a five-star rating and provides quality financial services with good value.

Regular savings account establishes your membership, and money market accounts enable you to earn dividends at higher rates.

The safety and security of your funds up to $250,000 can get insurance by NCUA, and this tax-deferred money will help with long-term saving goals.

With real estate loans, you can buy homes with fixed-rate home equity solutions and auto loans with a 4.74% APR.

And financial calculators will help you develop a financial plan and discover your economic potential in terms of loans.

Also with digital banking, you can apply for a loan, locate your money anytime, and use it for transactions.

Address: 40162 10th St W a2, Palmdale, CA 93551

2. Wescom Credit Union (Customized Investment Plans)

With $6 billion in assets, Wescom is the largest credit union in the country where strong liquidity and higher standards are preferred.

Financial advisors will help you develop customized investment plans for the present and future according to your financial goals.

And with financial calculators, you can monitor your progress.

The Wescom checking account provides fee-free ATM service, and Signature accounts provide relationship points to members.

Wescom cares about the environment and provides a 0.25% APR discount to electric vehicles and 125% financing with up to 7 years terms plan.

It also provides conventional and jumbo home loans of up to $5 million with up to 15 years of easy terms.

Get discounts on loans with auto and home insurance; it also provides life and pet insurance ensuring financial freedom.

Address: 39575 Trade Center Dr, Palmdale, CA 93551

Also see our article on Pool Companies in California.

Credit Union in Los Angeles, California

1. Los Angeles Federal Credit Union (Community Prosperity Focus)

LAFCU has a core principle of giving back to the community through the Los Angeles Charitable Associations to help the local community prosper.

To help entrepreneurs set up their businesses, Business Financing will help you earn loans with reasonable rates and without any prepayment penalties.

Youth accounts for members of 13-24 years help develop the habit of savings, and financial calculators develop basic economic principles.

The many insurance programs you can choose according to your budget will give you peace of mind.

Credit Union honors its members by giving them the Relationship Rewards, which consists of 5 points, and you can get a discount of up to 1% on loans.

And to protect the elders from theft or embezzlement, the union helps you with Elder Financial Abuse Protection.

Address: 201 N Los Angeles St #201, Los Angeles, CA 90012

2. USC Credit Union (Family-Focused Financial Services)

USC credit union works as a family giving you personal attention and comprehensive services to make you feel like an owner.

Making the students the financial managers of their own Student Checking and Savings Accounts give them financial freedom.

If you maintain high money, then with Value+ Savings Account, you will get higher dividends as high as 1.75% APY.

Buying has become easy with USC loans; you can earn loans with better competitive rates and lower fees.

The Student Loan refinance private and federal student loans with no hidden fees with the lowest rates of 5.270% APR.

CUSO financial services provide financial solutions to manage investment and earn long-term goals.

Address: 3720 Flower St, Los Angeles, CA 90007

3. Fox Federal Credit Union (Shared Savings & Dividends)

Fox Credit Union movement is “People helping people”, where members become owners and adhere to the highest responsibility standards.

The share savings account is essential, and you can open with a minimum of $30; dividends are shared equally with savings of $2500 or above.

Coverdell Education Savings account helps you to save for your child’s expenses with a minimum of $100 of the initial cost.

Personal loans with a duration of 12 months with competitive rates allow you to avoid debt or plan a vacation.

And Sallie Mae provides student loans with lower rates and without prepayment penalties to help them continue their studies.

TruStage Insurance helps devise the perfect financial plan and gives you financial relief when needed.

Address: 1990 Westwood Blvd Suite 270, Los Angeles, CA 90025

If you liked this article, you may also like to read about the best Pharmaceutical Companies, Electricity Companies, and Landscaping Companies in California.